Acquiring funds for a startup can be done with the help of an eight-step funding process.

The information age has introduced a rapid increase in the number of startup companies. The brains behind these startups are either young graduates from schools and colleges or someone who left their corporate job to pursue their dream (well, majorly). Whoever it may be, funding a startup is a difficult task. Many people try to fund their ideas themselves, while others rely on external funding to satisfy their needs.

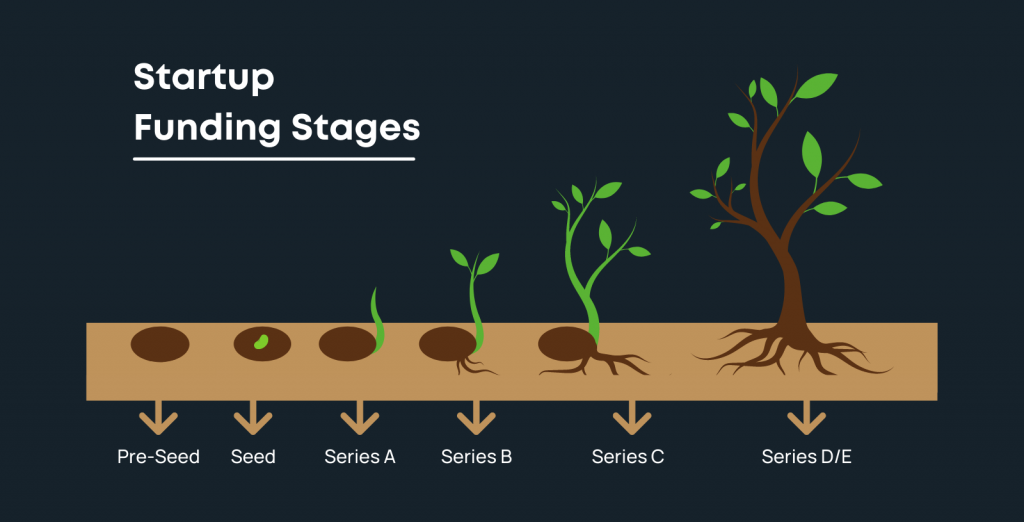

Acquiring funds for a startup can be done with the help of an eight-step funding process which involves different stages of startup funding. These startup funding stages are:

1. Pre-seed funding stage

Pre-seed funding is the first step in the funding process, commonly known as the bootstrapping stage. It mainly involves the startup owners using their own money or borrowing from their friends and family members. The total value of a startup in this stage can range anywhere from $10,000 to $1 million.

This stage is for the initial phases of the business when the startup has probably not even begun its operations. It is just in the market testing stage when the idea’s feasibility is determined. The costs would include funds for building the prototype, constructing a plan for the product launch, and developing ideas for various marketing and sales activities.

2. Seed funding stage

At this point, your idea is an actual business with some customer traction. Entrepreneurs in this phase provide company equity in return for large amounts of cash provided by investors.

In the seed funding phase, the owners try to raise funds to conduct market research and know their target customers’ tastes and preferences. Also, this is the stage where the product is developed for market release.

Startups valued anywhere from $1 million to $6 million are eligible for this fundraising phase. Money in this stage is usually collected from friends, families, angel investors, and even crowdfunding.

3. Series A funding

The Series A funding stage marks the beginning of venture capitalist investment, and shares of the company are offered in exchange for capital. At this point, the startup should have a product or service created and have a set customer base with a reliable income stream. The funds raised are expected to be used to gain revenues. It is a perfect open door that allows new companies to scale in various markets.

At this point, you can begin to set yourself up for future business growth. The funds raised may be up to $15 million and are used for marketing and improving brand credibility, tapping new markets, and helping the business grow.

4. Series B funding

Startups in this stage have dedicated user bases and steady streams of revenue. At this point, you’ve proven you can scale your idea. When a business relies on Series B investment, it portrays that the product is marketed right, and the customers are buying the product or service, as decided earlier. Investors can now help you employ advanced market reach activities, increase market share, and form operational teams such as business development and marketing.

Venture capitalists and late-stage venture capitalists usually do the funding in this stage. Their investment is around $30 million, and the company at this stage can expect a valuation as high as $60 million.

5. Series C funding

Series C funding is for a company well on its growth path and often interested in expanding globally. It may be easier to find investors at this stage, as they trust the startup to succeed. Funds at this phase are raised to build new products, reach new markets, and acquire underperforming startups in the same industry.

Investors in this stage know that the company is performing well, and the chances of it failing as a business are less. Due to less risk involved, many investment banks, hedge funds, and private equity firms show up in this stage. The startup gets valued at a high amount of $100-$120 million, and the approximate value of funds raised is approximately $50 million.

6. Series D funding and beyond

There are usually two reasons a startup goes past the Series C funding round. They are:

New opportunities: A potentially lucrative opportunity appears that requires the company to act before the Initial Public Offering (IPO).

Subpar performance: The startup misses the goals set during the Series C round of funding. It then raises more funds in the Series D round to address the issues.

There is no limit to how many funding rounds a startup can go through. If a company has more advanced revenue goals, it may complete as many fundraising series as necessary.

7. Mezzanine funding and bridge loans

These loans are for mature businesses worth at least $100 million. A mezzanine loan blends debt and equity for lenders, while bridge loans are short-term financing. They close the financial gap between this phase and the IPO. The funds might be used to buy out the management at another company or acquire a competitor. Loans typically last six to 12 months and are paid back with proceeds from the IPO.

8. IPO (Initial Public Offering)

An IPO is the pinnacle of startup success. When a startup decides to raise funds from the public, including institutional investors and individuals, by selling its shares, it is known as an IPO (Initial Public Offering). IPO is commonly related to going public as the general public now wants to invest in your company by buying shares. The IPO is used to generate funds for further growth or to allow the startup owners to cash out their remaining shares for personal income.

This is the last stage of the startup funding stages and helps the startup grow and diversify itself.

However, IPOs can be risky because the public is not aware of how the shares might trade in the market. On the other hand, though, the company might even perform well, and in that case, even the investors would be able to gain a lot.

5 thoughts on “The 8 Stages of Startup Funding”